Essential Guide to VA Home Loan Requirements in 2023

The VA Home Loan program is one of the most beneficial mortgage options available to veterans, active-duty service members, and some surviving spouses. It offers several advantages such as zero down payment, lower interest rates, and no private mortgage insurance. But like any loan, it comes with certain requirements. Understanding these VA home loan requirements is critical to navigating the home buying process effectively.

Federal Housing Administration (FHA) Loans: A Favorable Home Buyer Assistance Program

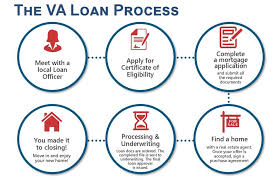

First and foremost, to qualify for a VA Home Loan, you need to meet the basic service requirements as set by the Department of Veterans Affairs. Eligibility is typically determined by the duration of service, service commitment, duty status, and character of service. You can confirm your eligibility by obtaining a Certificate of Eligibility (COE) through the VA’s eBenefits portal or your lender can request one on your behalf.

Loan Limit

As of 2023, the VA loan limit for most counties in the United States is $726,200 for those with full entitlement. This amount represents the maximum loan amount a veteran with full entitlement can obtain without a down payment. However, the VA doesn’t limit the amount you can borrow; rather, it limits the amount it will guarantee. If you can afford a larger loan and are willing to make a down payment, you can borrow more than the limit.

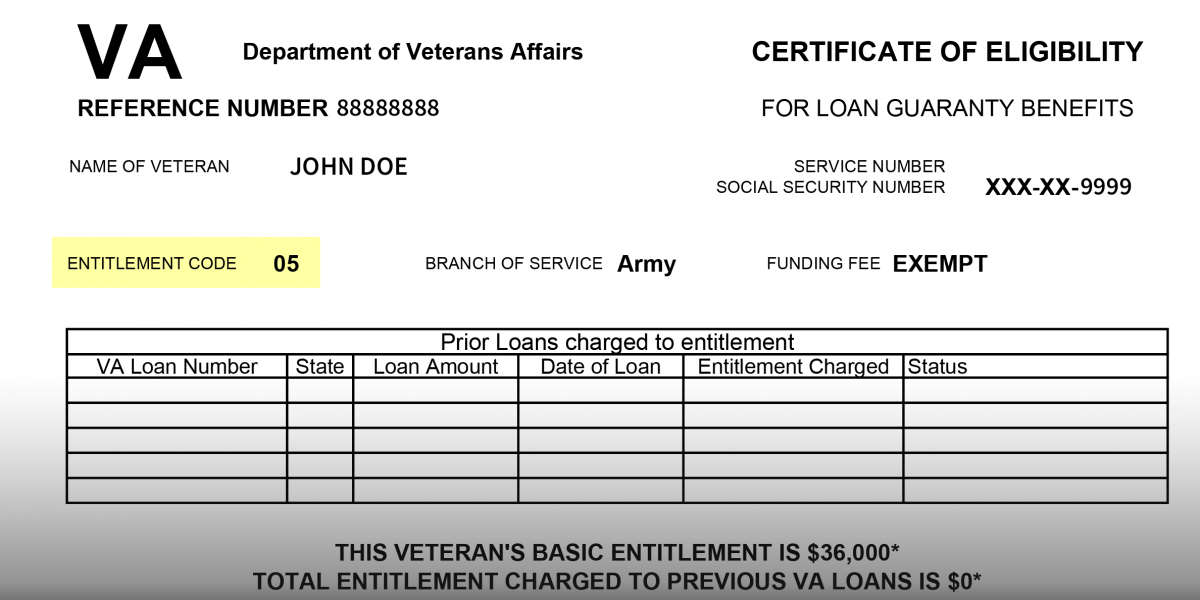

Understanding Your Certificate of Eligibility (COE)

The COE provides essential information about your VA loan eligibility and entitlement. Here’s how to understand some of the key elements in it:

Buying Another Home with a VA Loan

If you already have a VA loan and want to get another one, it’s possible, but it depends on how much of your entitlement you’ve used. Here’s how to calculate it:

- 1

Take the current Freddie Mac conforming loan limit ($726,200) and find 25% of it, which is $181,550. This is the maximum entitlement for most veterans.

- 2

Subtract the entitlement you’ve already used ($84,618, for example) from the maximum entitlement. In which case, you have $96,932 of entitlement left ($181,550 – $84,618).

- 3

You can then multiply this remaining entitlement by 4 to calculate the maximum loan amount you can get without a down payment. In this case, $96,932 * 4 = $387,728.

So, if you have an entitlement charged of $84,618 on your COE, you could potentially qualify for another VA loan up to $387,728 without needing a down payment. Of course, your income and credit history will also play a role in the lender’s decision.

Keep in mind that these calculations are rough estimates and the actual amounts can vary depending on various factors. You should always consult with a loan officer or financial advisor to understand your specific situation. For more detailed insights about VA home loans, visit our blog.

Length of Service

The specific length of service requirements varies depending on when you served, but here are the basic guidelines:

- 1Your Content Goes Here

- 2

181 days of active service during peacetime.

- 3

6 years in the Reserves or National Guard.

Discharge Conditions

Honorable discharge is usually required, though some other discharges may be accepted under certain conditions. Check the VA’s specific requirements for more detailed information.

Credit and Income Requirements

The VA doesn’t set a minimum credit score for VA home loans, but lenders usually have their own requirements. Many lenders look for a credit score of 620 or higher. However, because VA loans are partially guaranteed by the VA, lenders may have more flexibility with credit scores.

The VA also doesn’t set a maximum debt-to-income (DTI) ratio, but it recommends a DTI of 41% or less. Your DTI ratio is the percentage of your gross monthly income that goes toward paying debts.

Property Requirements

Lastly, the home you purchase with a VA loan must meet VA’s Minimum Property Requirements (MPRs). These ensure the home is safe, sound, and sanitary. MPRs cover a range of issues, from structural soundness to basic sanitary facilities, and the property must be used for residential purposes.

Remember, VA home loan requirements can be complex. Reach out to your lender or a VA loan specialist to guide you through the process. For more insights about home buying and VA home loans, check out our blog for more articles.

news via inbox

Subscribe to our newsletter for the latest on Las Vegas outdoor activities and real estate insights. Dive deeper into Las Vegas living. Click below and join our community today!